Unlock The Future Of Finance: Register Now & Explore!

Are you ready to step into a world where traditional finance meets cutting-edge technology, where accessibility and innovation redefine how we manage our money? The future of finance is no longer a distant dream; it's an evolving reality accessible to anyone willing to embrace the change.

The financial landscape is undergoing a seismic shift, driven by the rapid advancement of technology. We're witnessing the emergence of decentralized finance (DeFi), blockchain technology, and a host of innovative platforms designed to empower individuals and businesses alike. "Register now and experience the future of finance" isn't just a marketing slogan; it's an invitation to participate in a revolution. As Arabic speakers are urged to " ," and Russian speakers are encouraged to " ," the message is clear: the future of finance is global and inclusive.

| Area | Details |

| Key Concept | The Future of Finance |

| Description | Encompasses innovative technologies and approaches that are reshaping traditional financial systems, making them more accessible, efficient, and transparent. |

| Key Technologies | Blockchain, Cryptocurrency, Decentralized Finance (DeFi), Fintech |

| Benefits | Increased financial inclusion, faster transactions, reduced costs, greater transparency, and innovative financial products. |

| Challenges | Regulatory uncertainty, security risks, technological complexity, and scalability issues. |

| Potential Impact | Transformation of banking, investment, payments, and insurance industries, empowering individuals and businesses globally. |

| Reference Website | Investopedia - Future of Finance |

This isn't limited to any single geographic location or demographic. From Vietnam, where people are told "\u0110\u0103ng k\u00fd ngay v\u00e0 tr\u1ea3i nghi\u1ec7m t\u01b0\u01a1ng lai c\u1ee7a ng\u00e0nh t\u00e0i ch\u00ednh," to every corner of the globe, there's a growing recognition that the old ways of managing money are evolving. The potential to engage with web3, invest in DeFi, and explore NFTs, as encouraged by Russian speakers ( web3, defi nft.), is opening doors for financial freedom and innovation that were previously unimaginable.

- Haunted Rancher Finds Solace As A Bouncer A Movie Summary

- Latest Telugu Movies Reviews Streaming News Yearly Guide

One of the core principles driving this revolution is decentralization. The traditional financial system is built on intermediaries banks, brokers, and other institutions that act as gatekeepers. DeFi seeks to eliminate these intermediaries, allowing individuals to interact directly with each other through smart contracts and blockchain technology. This creates a more transparent, efficient, and accessible financial system.

Cryptocurrencies are playing a crucial role in this transformation. Bitcoin, Ethereum, and other digital currencies are providing an alternative to traditional fiat currencies, offering greater control and autonomy to users. They also serve as a gateway to the world of DeFi, enabling individuals to participate in a wide range of financial activities, such as lending, borrowing, and trading.

However, the future of finance isn't without its challenges. Regulatory uncertainty remains a significant hurdle, as governments around the world grapple with how to regulate cryptocurrencies and DeFi. Security risks are also a concern, as the nascent nature of the technology makes it vulnerable to hacks and exploits. Its crucial to approach these opportunities with both enthusiasm and caution. " (BTC) " the Chinese prompt asks if you're ready to catch the next wave after digital currencies and Bitcoin (BTC). It highlights the need for a simple and easy-to-use app to explore Bitcoin and other cryptocurrencies, emphasizing secure trading and storage of digital assets. The trust of over 50 million crypto traders in 160 countries, and the "Most Trusted Technology" award from TradingView, underscore the potential and reliability of these new financial tools.

- Movierulz Kannada Your Guide To Streaming New Releases

- Movierulz Movie Download Everything You Need To Know Guide

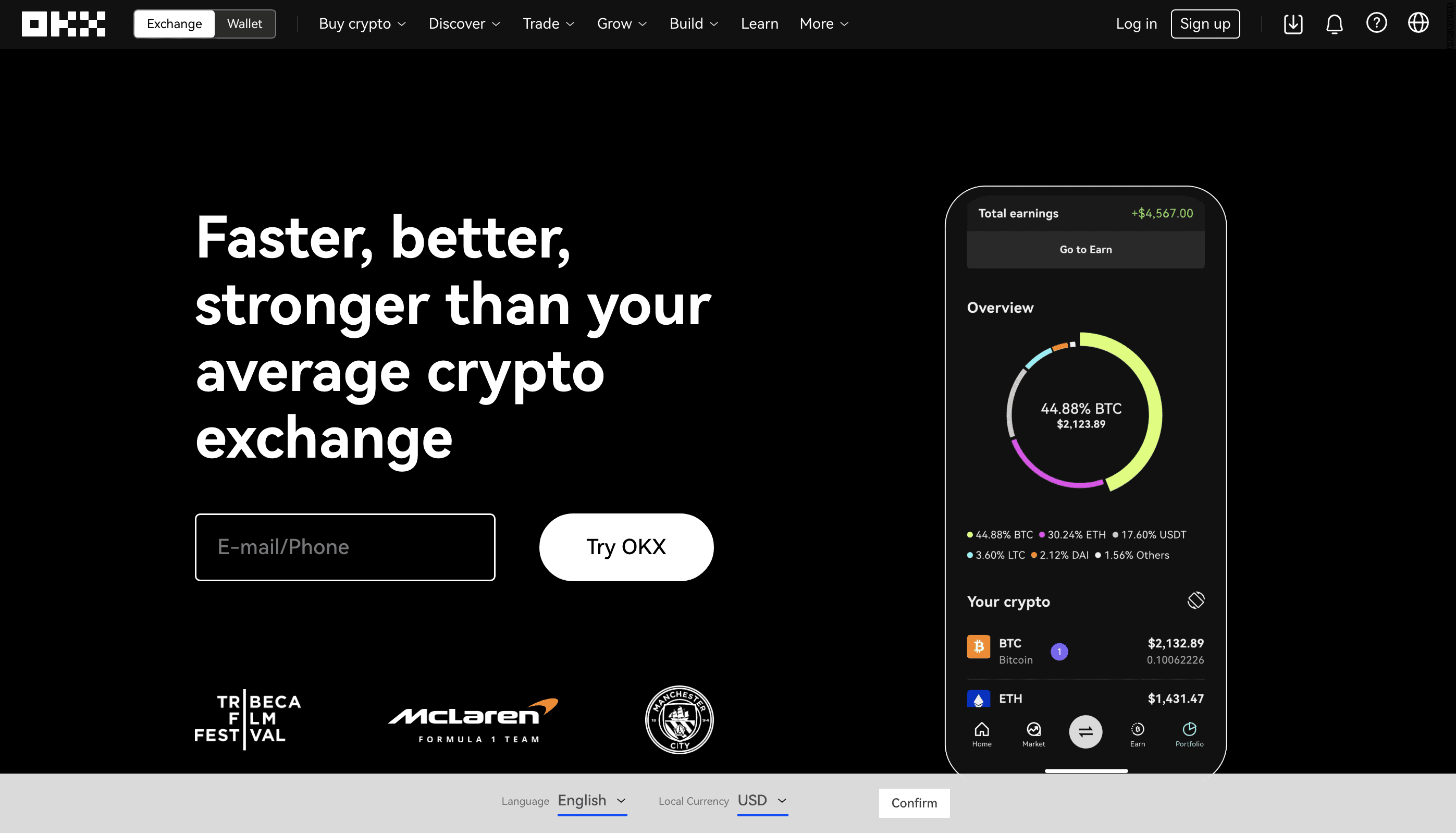

Despite these challenges, the potential benefits of the future of finance are too significant to ignore. Increased financial inclusion is a key driver, as DeFi and cryptocurrencies offer access to financial services for the unbanked and underbanked populations around the world. Faster and cheaper transactions are another major advantage, as blockchain technology can streamline payments and reduce the need for intermediaries. Furthermore, the innovation in financial products and services is accelerating, with new platforms and applications emerging all the time. OKX, as a globally recognized brand, is a testament to the growing adoption and acceptance of these new technologies.

The rise of NFTs (Non-Fungible Tokens) further expands the possibilities within the future of finance. NFTs represent unique digital assets, such as artwork, music, and collectibles, and they are transforming the way we create, own, and trade digital content. They also offer new opportunities for artists and creators to monetize their work directly, without relying on traditional intermediaries.

As we move forward, it's essential to stay informed and educated about the latest developments in the future of finance. Explore the technology, understand the risks, and be prepared to adapt to the evolving landscape. The financial world is undergoing a profound transformation, and those who embrace change will be best positioned to benefit from it.

Consider the broader implications of these shifts. The traditional banking sector, for example, faces disruption from DeFi and other fintech innovations. Banks must adapt by embracing new technologies and offering more competitive services to retain their customers. Investment firms are also exploring the potential of cryptocurrencies and blockchain, integrating these assets into their portfolios and developing new investment strategies. Even the insurance industry is being impacted, with blockchain-based solutions offering more transparent and efficient claims processing.

The ongoing evolution of regulations will play a critical role in shaping the future of finance. Clear and consistent regulations are needed to foster innovation while protecting consumers and preventing illicit activities. Collaboration between governments, industry players, and regulatory bodies is essential to strike the right balance and ensure that the future of finance is both innovative and secure.

Education and awareness are also paramount. Many people remain unfamiliar with cryptocurrencies, DeFi, and other related technologies. Providing accessible and unbiased information is crucial to empower individuals to make informed decisions and participate in the evolving financial landscape. Online courses, workshops, and educational resources can play a vital role in bridging the knowledge gap.

The user experience is another area that demands attention. Many DeFi platforms and cryptocurrency wallets are still complex and difficult to use, hindering wider adoption. Improving the user interface and simplifying the onboarding process are essential to make these technologies more accessible to the average person. Intuitive design and user-friendly tools will be critical in attracting new users and driving mainstream adoption.

Looking ahead, we can expect to see further integration of artificial intelligence (AI) and machine learning (ML) in the future of finance. AI and ML can be used to automate tasks, improve risk management, and personalize financial services. For example, AI-powered trading algorithms can analyze market data and execute trades more efficiently, while ML models can detect fraud and prevent money laundering. These technologies have the potential to revolutionize the way financial institutions operate and deliver value to their customers.

The convergence of different technologies will also play a significant role. The integration of blockchain with the Internet of Things (IoT) can enable secure and transparent data sharing between devices, while the combination of blockchain with augmented reality (AR) and virtual reality (VR) can create immersive financial experiences. These integrations will unlock new possibilities and transform the way we interact with financial services.

Sustainability is becoming an increasingly important consideration in the future of finance. Investors are increasingly focused on environmental, social, and governance (ESG) factors, and they are demanding more sustainable investment options. Blockchain technology can be used to track and verify ESG data, ensuring that investments are aligned with ethical and environmental principles. The rise of green finance and impact investing will further drive the adoption of sustainable practices in the financial industry.

The COVID-19 pandemic accelerated the adoption of digital financial services, as people turned to online platforms to manage their money and conduct transactions. This trend is expected to continue, as consumers increasingly demand convenient and seamless digital experiences. The future of finance will be characterized by greater reliance on mobile devices, cloud computing, and other digital technologies.

Cybersecurity will remain a top priority in the future of finance. As the financial system becomes more interconnected and reliant on digital infrastructure, the risk of cyberattacks will continue to grow. Robust cybersecurity measures are essential to protect financial data, prevent fraud, and maintain the integrity of the system. Collaboration between financial institutions, cybersecurity experts, and government agencies is crucial to address this challenge.

The rise of central bank digital currencies (CBDCs) could also have a significant impact on the future of finance. CBDCs are digital currencies issued by central banks, and they could offer a number of advantages over traditional fiat currencies, such as faster and cheaper payments, greater financial inclusion, and improved monetary policy. However, the development and implementation of CBDCs also raise a number of complex issues, such as privacy, security, and financial stability.

As the future of finance unfolds, it's important to remember that technology is just a tool. The ultimate goal is to create a financial system that is more inclusive, efficient, and sustainable. This requires a focus on human needs and values, as well as a commitment to ethical principles. By embracing innovation and collaboration, we can build a better future for finance that benefits everyone.

The democratization of finance is a recurring theme. Individuals are gaining more control over their financial lives, thanks to the accessibility of new technologies and platforms. This shift empowers people to manage their investments, access credit, and send payments without relying on traditional financial institutions. The future of finance is about putting the power back in the hands of the people.

Globalization is another key factor shaping the future of finance. Cross-border transactions are becoming easier and cheaper, thanks to blockchain technology and digital currencies. This facilitates international trade, investment, and remittances, connecting people and businesses around the world. The future of finance is global, borderless, and interconnected.

The role of data is also evolving. Financial institutions are collecting vast amounts of data about their customers, and they are using this data to personalize services, improve risk management, and detect fraud. However, the use of data also raises privacy concerns, and it's important to ensure that data is used ethically and responsibly. The future of finance will be data-driven, but it must also be privacy-conscious.

Financial literacy is more important than ever. As the financial landscape becomes more complex, it's essential for individuals to have a solid understanding of financial concepts and principles. This empowers people to make informed decisions about their money and avoid financial pitfalls. Financial education should be accessible to everyone, regardless of their background or income level.

The gig economy is also influencing the future of finance. More people are working as freelancers or independent contractors, and they need access to financial services that are tailored to their needs. This includes tools for managing income, tracking expenses, and saving for retirement. The future of finance will be more flexible and adaptable to the needs of the gig economy.

The rise of mobile payments is transforming the way we transact. Mobile wallets and payment apps are becoming increasingly popular, offering convenient and secure ways to pay for goods and services. This trend is particularly pronounced in developing countries, where mobile payments are leapfrogging traditional banking infrastructure. The future of finance is mobile-first, accessible anytime, anywhere.

The sharing economy is also impacting the future of finance. Peer-to-peer lending platforms and crowdfunding sites are connecting borrowers and investors directly, bypassing traditional intermediaries. This creates new opportunities for individuals and businesses to access capital and generate returns. The future of finance is collaborative, peer-to-peer, and community-driven.

The aging population is creating new challenges and opportunities for the financial industry. As people live longer, they need to save more for retirement and manage their finances more carefully. This requires innovative financial products and services that are tailored to the needs of older adults. The future of finance must address the challenges of an aging population.

Climate change is also a major concern. Financial institutions are increasingly aware of the risks associated with climate change, and they are taking steps to reduce their carbon footprint and invest in sustainable solutions. This includes financing renewable energy projects, promoting energy efficiency, and supporting climate adaptation efforts. The future of finance must be climate-resilient and environmentally responsible.

The integration of behavioral economics is also gaining traction. Financial institutions are using insights from behavioral economics to design products and services that are more effective and engaging. This includes techniques such as nudging, framing, and loss aversion. The future of finance will be more human-centered, taking into account the psychological factors that influence financial decision-making.

The rise of financial influencers is also shaping the future of finance. Social media influencers are providing financial advice and recommendations to their followers, often reaching a large and engaged audience. However, it's important to be cautious about relying on financial advice from social media influencers, as they may not have the necessary expertise or qualifications. The future of finance will be more social, but it must also be based on sound financial principles.

The increasing focus on financial wellness is a positive trend. Financial institutions are recognizing that financial health is an important aspect of overall well-being, and they are offering programs and services to help people manage their finances more effectively. This includes tools for budgeting, saving, and debt management. The future of finance will be more holistic, promoting financial wellness and empowering people to achieve their financial goals.

Ultimately, the future of finance is about creating a more equitable and sustainable financial system that benefits everyone. This requires a commitment to innovation, collaboration, and ethical principles. By embracing change and working together, we can build a better future for finance that is more inclusive, efficient, and resilient.

Article Recommendations

- Vegamovies Watch Bollywood Hindi Tamil Telugu Dubbed Movies

- Haunted Rancher Finds Solace As A Bouncer A Movie Summary

Detail Author:

- Name : Lola Schiller

- Username : hettinger.brendan

- Email : theodore14@parisian.biz

- Birthdate : 1982-01-04

- Address : 46343 Kuhlman Station Sawaynfurt, NY 14284-8663

- Phone : +1-360-667-5837

- Company : Stehr-Pfannerstill

- Job : Maintenance Worker

- Bio : Necessitatibus ipsum pariatur quaerat. Temporibus qui aut ex hic laboriosam expedita. Delectus enim et officia.

Socials

linkedin:

- url : https://linkedin.com/in/ulises_official

- username : ulises_official

- bio : Ea sit ea qui non sed sint.

- followers : 6420

- following : 2539

twitter:

- url : https://twitter.com/uliseskiehn

- username : uliseskiehn

- bio : Ex vero consequuntur autem. Laudantium est ut officia tempore aut corrupti. Ut iure sunt illo.

- followers : 3284

- following : 1126

tiktok:

- url : https://tiktok.com/@ulises_xx

- username : ulises_xx

- bio : Odio et ut commodi. Consequatur sit cum omnis dolor voluptas quidem cumque.

- followers : 1030

- following : 50